Understanding Contra Expense Accounts in Financial Accounting

A second example of a contra asset account is Accumulated Depreciation. An asset that is recorded as a credit balance is used to decrease the balance of an asset. This account is not classified as an asset since it does not represent a long-term value. It is not classified as a liability since it does not constitute a future obligation. Contra equity reduces the total number of outstanding shares on the balance sheet.

Liability Contra Account

Home Depot reports net receivables and net property and equipment, implying that both are reduced by contra assets. We’ll need to dig into the footnotes to find out what the contra accounts are. A contra account plays a significant role in business by providing a clearer, more detailed picture of the financial situation. They ensure that the assets, revenues, and equity reported are not overstated, and that liabilities are presented in relation to any discounts or premiums.

Accounting made for beginners

- Contra expense accounts play a crucial role in financial accounting, offering a nuanced way to track and report reductions in expenses.

- And why stop at just theory when you can apply what you’ve learned using premium templates?

- It is not classified as a liability since it does not constitute a future obligation.

- Maintaining contra revenue accounts empowers you to maintain healthier and more realistic expectations of financial outcomes—no rose-tinted glasses here.

- For instance, a sudden increase in purchase returns recorded in a contra expense account might signal issues with supplier quality or internal procurement processes.

For example, an increase in the form of a credit to allowance for doubtful accounts is also recorded as a debit to increase bad debt expense. A contra account is an essential concept in financial accounting that serves to offset the balance of another account. It plays a vital role in maintaining contra expense account examples the accuracy and transparency of a company’s financial statements. Contra accounts are used to record adjustments, reversals, or reductions in the value of assets or liabilities. Revenue is an income statement account, but it flows through to the equity section of retained earnings as well.

Contra assets

Contra expense accounts are indispensable tools in financial analysis, offering a nuanced lens through which analysts can assess a company’s cost management strategies. By providing a more accurate depiction of net expenses, these accounts enable analysts to delve deeper into the efficiency of a company’s operations. This deeper insight is particularly valuable when comparing financial performance across different periods or against industry benchmarks. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid.

Contra accounts are used to reduce the value of the original account directly to keep financial accounting records clean. When looking at the balance sheet, it is essential to understand what is being shown on the two sides – the assets debit balance and the liabilities credit balance. The assets are always shown on the left-hand side, and the liabilities are always displayed on the right-hand side. Of that amount, it is estimated that 1% of that amount will become bad debt at some point in the future. This means that the $85,000 balance is overstated compared to its real value.

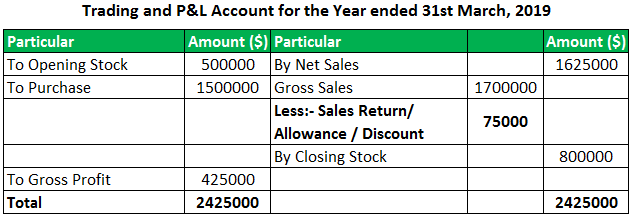

How to Read a P&L Statement (Explained by an Accountant)

The company estimates that it will not be able to collect 1,000 from its customers. The allowance for doubtful accounts is a contra asset account that is used to offset Accounts Receivable on the balance sheet. If we apply accounting rules and assign value to the tools borrowed, technically speaking, we both have an account receivable (AR) and an account payable (AP) to each other for the equipment/tools borrowed. Bad debt is uncollectible revenue, which offsets a doubtful receivable. Depreciation is an offset of the value of PP&E (Property, Plant, and Equipment). These examples illustrate how contra accounts are used in various contexts to provide a more accurate picture of a company’s financial position and performance.

These transactions are reported in one or more contra revenue accounts, which usually have a debit balance and reduce the total amount of the company’s net revenue. Equity recorded as a debit balance is used to decrease the balance of a standard equity account. It is a reduction from equity because it represents the amount paid by a corporation to buy back its stock.

Each of these contra accounts serves to provide more detailed information about the transaction history of the related main account. By tracking contra accounts, a company can make more informed decisions about asset management, liability settlement, and overall financial planning. The contra equity account treasury stock is reported right on the balance sheet. Home Depot has repurchased more than $72 billion of stock to date, with around $7 billion coming during this accounting period.