An easy Note with the Individual Financial Insurance

CHFA together with requires that you’re taking property customer education classification. Categories are available online and inside the-individual. CHFA recommends using the class very early using your family look thus your happy to to find a lender and you will a house agent who will be an informed complement your.

As the we discussed, particular software features low down payment requirements to possess first time domestic customers. But many of them applications feature a supplementary monthly pricing called personal financial insurance (PMI). PMI is simply an agenda that you have to get (at the individual bills) which covers the lending company in the event you wind up defaulting with the their mortgage.

PMI is normally required by the financial institution for individuals who set smaller than a beneficial 20% downpayment on your family. The cost of PMI is oftentimes ranging from 0.5% and step one% of the total amount borrowed. It results in $1,000 a year per $100,000 borrowed. This means that, while taking out a $2 hundred,000 financial, you’ll are obligated to pay an additional $166 payment to have PMI.

New Government Homeowners Safeguards Work offers the right to ask a lender to get rid of PMI once you have at the least 20% family equity. This means you possess 20% of your property both since the you have paid off anywhere near this much, otherwise while the markets works in your favor and you may increases the total worth of your property.

Federal Applications to own Basic-Go out Homebuyers

Federal financial apps bring an alternative choice for first time homebuyers inside the Colorado. Particularly, while struggling to meet with the borrowing requirements of regional state software, a national program may provide far more independence. Here are some choice which can be popular with first-time homebuyers as they accept lower credit ratings and gives off payment guidance.

FHA mortgage: An FHA mortgage is a great option when you yourself have good lowest credit rating. A credit rating regarding 580 or maybe more could possibly get allows you to establish just step three% into the property get. A credit history less than 580 needs good 10% down-payment.

Va loans: Virtual assistant fund try glamorous because they do not need an advance payment, and credit history criteria try flexible. You really must be active in the military, a veteran, or a qualifying partner to use this program. At the same time, no PMI is required for it system.

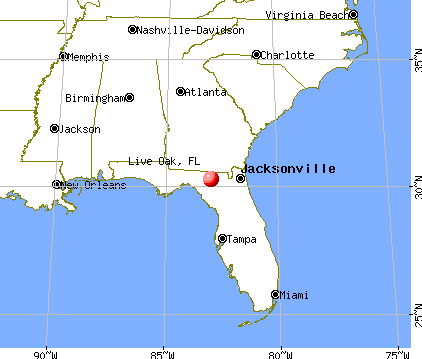

USDA finance: USDA finance are around for accredited borrowers to buy in a few geographical parts. It generally includes outlying section which have communities out of lower than 20,000. There’s absolutely no downpayment requirements, however the borrower requires a credit rating away from 640 or higher.

Carrying out a stronger Financial Upcoming

Because a first and initial time house customer inside Tx, you can access special applications that almost every other people can not availability. is great for the disease was a personal options, but it starts with inquiring a few questions: The amount of money are you willing to manage to put down into family pick? What exactly is your credit rating? Just how much might you afford to shell out monthly?

We understand the facts feels overwhelming, nevertheless research you are creating now is the perfect very first action! The more you are aware concerning possibilities together with better you know your own to get electricity and limits the greater status you will be in to secure down your perfect family.

Extremely loan providers use a debt-to-income ratio and do not along these loans Waldo AL lines ratio so you’re able to go beyond 43%, with regards to the system. Such as for example, let’s say that you bring in a terrible salary of $4,000 monthly (extent just before taxes otherwise deductions are applied for). Their complete quantity of financial obligation, such as the mortgage, bank card costs, and you may vehicles repayments are $step 1,750. Split your debt of the earnings while rating an effective DTI proportion away from 43%. In cases like this, if the debt goes one large, you will likely find it difficult qualifying toward CHFA program.