What to expect about Home buying Processes in the event that Purchasing which have Cash

Good newsgreen card proprietors can be indeed buy a house from inside the Joined Claims. Actually, you would not actually need to be a resident of the Us to shop for property. However, because the a low-resident, related measures (such as acquiring a loan) possess issue. Not one are insurmountable otherwise is to prevent environmentally friendly cards holders out of seeking owning a home.

To aid low-owners navigate the fresh new already-challenging home-to find excursion, we built this guide and compiled this new remedies for apparently requested issues.

The first thing possible without doubt find is that that it area is pretty short, serving because a direct meditation of the property to order processes getting green cards people using with dollars (unlike a loan). Simply because certain requirements to have non-customers copy the requirements to possess people; you may need a federal government-approved ID and evidence of the cash.

Of a lot eco-friendly cards proprietors or other low-people usually choose to use American money when purchasing their property. But not, in the event you desire to use overseas financing, they will certainly need reason for changing currency exchange bad credit installment loans Arizona cost and you will people relevant fees into their finances.

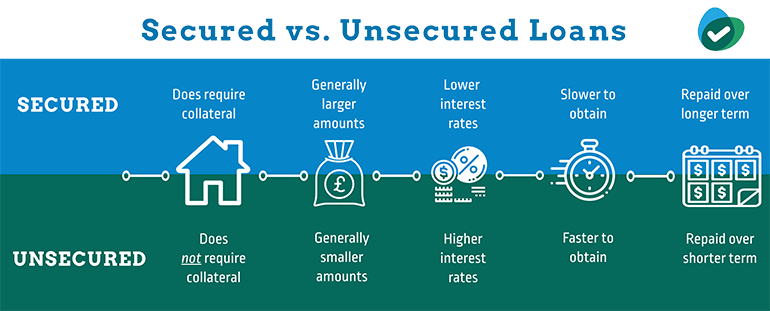

These aside, the process of getting a mortgage really complicates the home-to shop for adventure to possess green credit holders or other low-residents.

Understanding the Procedure for Bringing an interest rate just like the a low-Resident

Environmentally friendly cards people and you can low-long lasting resident aliens are certain to get a simpler date obtaining that loan than low-residents; regarding the angle from lenders, the fresh new sources green cards holders dependent in their All of us organizations mean that they’re expected to focus on their home loan more than other costs so you can retain their property.

Exactly what Records and Tips carry out Eco-friendly Card Owners and you can Non-People Need certainly to Give When Making an application for a home loan:

- Acknowledged sorts of regulators ID this may involve your passport, license, otherwise visa

- Facts out of money the most famous particular info try bank statements and you may tax yields

- Evidence of money Their lender would like to have a look at pay slips and you can tax statements throughout the past couple of years. 1099 models is a suitable alternative for thinking-operating eco-friendly card people

- Social Safety Matter (SSN)

- Private Taxation Character Matter (ITIN)

Other content that your bank may request are:

- Savings account guidance

- Monetary possessions, in addition to financial investments and you can retirement accounts

- Assets suggestions

- Costs having repeating debts (instance rent and you can resources) to exhibit financial responsibility

What to anticipate while the a non-Citizen?

But what on non-citizens, and thus he or she is none an eco-friendly card owner otherwise enjoys a SSN of are a low-permanent citizen alien? Providing financing is totally you’ll be able to, but choices was limited. Particular All of us banks bring international national money particularly for such as for instance home-people, but standards and you can prices will often be higher. This can be because this new funds will not be supported by Fannie Mae or Freddie Mac computer, government-backed organizations (GSEs) one to ensure the mortgage loans out-of accredited individuals in order to incentivize lower costs to possess borrowers.

Think about Credit file getting Environmentally friendly Cards Proprietors and you can Non-Owners?

It is common to have loan companies to check on the credit reputation of borrowers, top specific eco-friendly credit people so you can wonder if or not worldwide purchases (both negative and positive) will have people hit to their costs.

Fico scores dont roll-over in one nation into the second (not really ranging from surrounding nations such as the You and you may Canada). However, the credit record you collected abroad are not null and gap, as numerous loan providers have a tendency to pull a global Credit history (ICR) to get to a larger picture of your financial background. Instance data files will give a score (equal to the us credit scoring system), also information eg financing and you can bill costs, early in the day and give levels, and you will an excellent expense.